Recent hot models: Motion sensors, memory, and microcontrollers are experiencing a significant increase in popularity.

Recently, popular materials have been occupied by motion sensors and memory devices.

Model:

- W25Q128JVSIQ

- ICM-42688-P

- W25Q64JVSSIQ

- KLM8G1GETF-B041

- ICM-42670-P

- W25Q32JVSSIQ

- MT41K256M16TW-107:P

- STM32F103C8T6

- MT41K256M16TW-107 IT:P

- W25N01GVZEIG

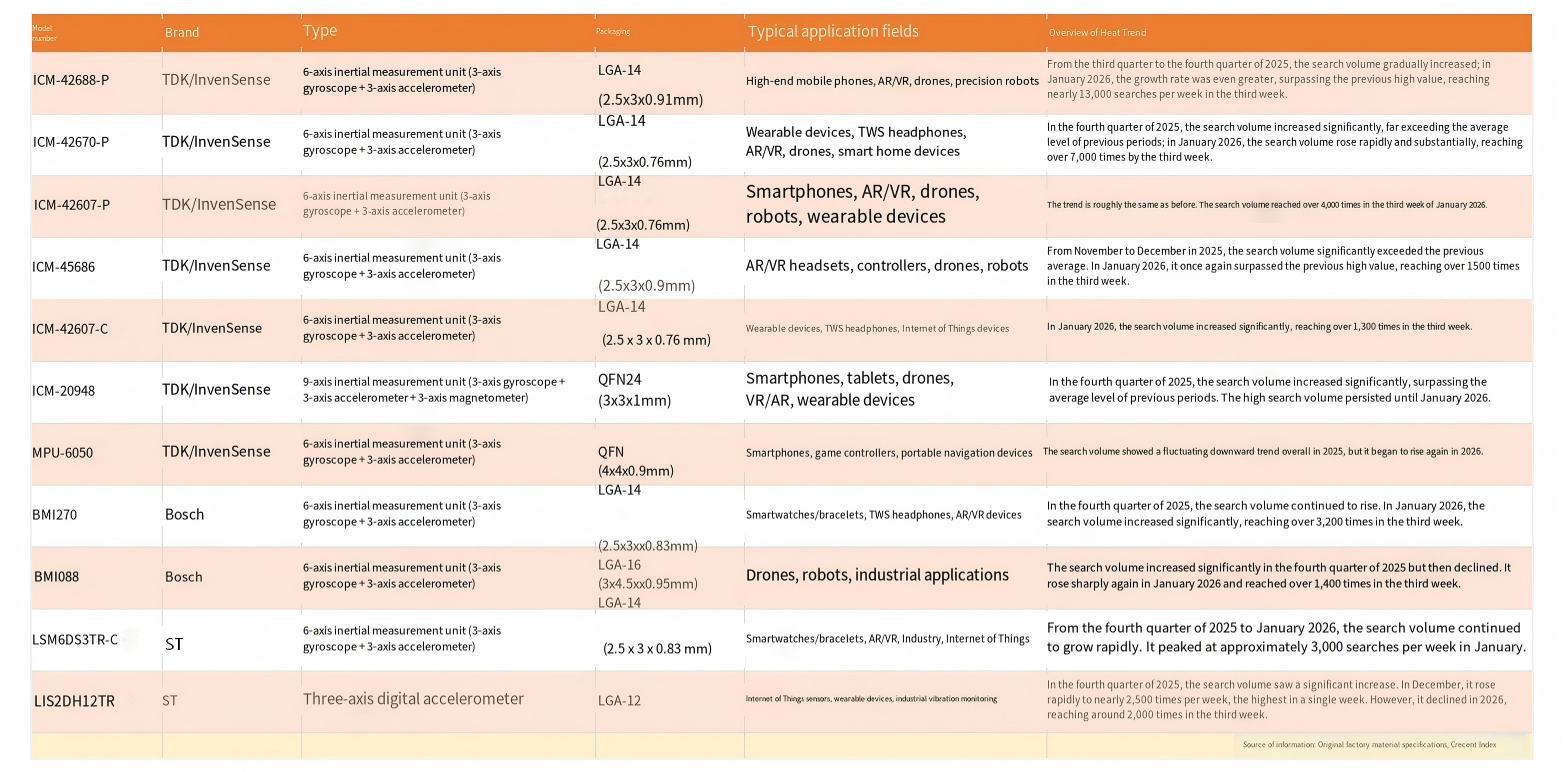

Structural bull market emerges for IMU

The 6-axis inertial measurement unit (IMU) ICM-42688-P of TDK/InvenSense has seen a rise in popularity since last year and has become a popular component. With its high precision and low noise characteristics, it is suitable for applications in drones, robots, AR/VR, etc.Not only the continuous popularity of ICM-42688-P, but the overall popularity of IMU devices has not waned. Not only has the popularity of more products under TDK/InvenSense increased significantly, but also products from Bosch and ST have joined in, forming a structural bull market in the IMU market.

The product line of TDK/InvenSense has the widest coverage and holds a leading position in both the high-end (ICM-42688-P) and mainstream consumer (ICM-42670-P) markets. It is a demand trend indicator. Bosch products have deeply rooted in the consumer smart (BMI270) and industrial reliable (BMI088) markets, forming a differentiated advantage. ST, with mature and cost-effective models such as LSM6DS3TR-C, maintains a stable share in a wide range of basic industrial and consumer markets. The prices of these IMU materials have already exceeded the normal level.

From the demand perspective, the expansion momentum in areas such as automotive electronics (autonomous driving/advanced driver assistance), drones, AR/VR, and wearable devices is clear. It is strongly driven by the strong push of emerging application markets, breakthroughs in key policies, and technological platform iterations. Market opportunities will also be reflected in multiple high-growth sectors.

The general growth of various models starting from the fourth quarter of 2025 coincides with the new product definition cycle of consumer electronics and the budget cycle of industrial fiscal years; the leap-like growth in January 2026 is likely to indicate the arrival of the peak for spring production preparation.

Memory still holds a dominant position.

Entering 2026, the memory market continues to heat up. The capacity squeeze caused by AI demand and the ongoing expectation of capacity reduction are strengthening the fundamentals of this round of memory market. Therefore, this round of market shows a pattern where mainstream memory types such as memory, NAND flash, and NOR flash all strengthen.In the case of NAND flash, the search volume of Samsung's eMMC flash KLM8G1GETF-B041 continued to increase on the basis of the high level in December last year. In addition, the search volumes of SLAC models from Winbond, Hua-Bang, and Madcui Innovation, as well as MLC models from Kioxia, also increased significantly.

In the case of DRAM, the heat of Samsung, Micron, and SK Hynix's DDR3 materials continued to increase significantly; the growth of Micron's DDR4 materials slowed down, while South Asia's DDR4 increased significantly, showing differences. In DDR5, the search volumes of SK Hynix's 16Gb model and Samsung's RDIMM module increased significantly, reflecting the strong demand from new application fields such as AI servers.

In terms of prices, according to the analysis of current market institutions, the several major mainstream memory types are in an upward cycle driven by AI demand and triggered by capacity squeeze. It is expected that the market will continue to strengthen in the first half of 2026. In addition to AI, the demand growth in a series of applications including consumer electronics, automobiles, and industry, will also boost the memory market to continue to strengthen.

STM32 series remains a hot topic

Since December last year, the search volume for STM32G431CBU6 has continued to increase. From an application perspective, this device has similar core performance compared to the STM32F4 series, but it has achieved "specialization and refinement" in analog integration and real-time computing, making it suitable for some high-end motor drive, power supply or inverter control applications.This round of chip price increase wave, MCU is not really the "main character", but the recent hot chip also indicates that there is a huge demand emerging in the intelligent field, representing the future development direction.